Welcome to As Built! What started as a small dive into the DOE’s commercial plutonium program turned into a larger thought experiment on nuclear fuel security. This will wrap up this fall’s focus on nuclear. Engineering topics will fill the next few weeks, followed by a dive into space.

I learned more while writing the piece than any other, and my thoughts on the nuclear fuel cycle have evolved significantly. Hopefully you find it interesting as well, and I'd love to hear your thoughts!

This is the second piece in a two-part series on nuclear fuel. While reactors garner significant attention, creating the fuel that powers them is equally challenging—if not more so.

In the last essay, we posed two questions:

How exactly do we fuel reactors?

Does the U.S. have nuclear fuel security?

We addressed the first, uncovering some striking insights:

Except for Canada, every major nuclear power (the U.S., France, Russia, and China) depends on uranium imports.

Russia controls 43% of global enrichment capacity.

The U.S. continues to import enriched uranium from Russia; U.S. companies have secured waivers to do so through 2027.

From 1993 to 2013, Russia turned warheads into reactor fuel, supplying 10% of U.S. electricity during that period.

We also began exploring fuel security. The U.S. is highly reliant on foreign supply chains, most acutely in mining and enrichment, where the annual needs are:

15,500 metric tons (MT) of uranium—99% imported

12 million separative work units (SWU) of enrichment—60% imported

But fuel security isn’t just about today’s supply. It’s about future options. How hard is it to get more reactor fuel? And how would we do it?

This essay examines eight opportunities. None is a silver bullet. Each chips away at the problem, some better than others. They also aren’t mutually exclusive, and in fact, a composite strategy is almost certainly required. Combined, however, they can chart paths to assured access to nuclear fuel.

Setting the Stage

This is a thought experiment. It explores the art of the possible, and doesn’t necessarily advocate for any one strategy. Assumptions are intended to be reasonable, and numbers are grounded in industry and government reporting.

We juggle many values—types of uranium, enrichment levels, etc.—so some are rounded for readability. Yet, no conclusions are altered from this.

Since any improvements to the fuel chain will play out over the next five to ten years, we set the baseline need in 2035 to a 33% increase in uranium and enrichment demand relative to today. This is a middle-of-the-road estimate, and exact growth depends on how quickly new plants come online.

We make two other key assumptions. First, the U.S. light water reactor fleet uses fuel enriched to an average of 4.4% U-235. Second, modern centrifuge enrichment produces tails at 0.3% U-235. Tails are the leftovers from enrichment—the part that didn’t get enriched. Their concentration represents U-235 that wasn’t extracted for nuclear fuel (as a reminder, natural uranium contains 0.7% U-235).

Our 2035 scenario therefore demands:

20,000 MT of 0.7% natural uranium (NatU)

16 million SWU of enrichment

0.3% centrifuge tails assay

2,000 MT of 4.4% low enriched uranium (LEU)

First, we’ll build a menu of opportunities. Then we’ll assemble them into a representative plan.

Opportunity 1: Import Foreign Uranium and Rely on Diplomacy

The first option is the least drastic—akin to doing nothing. Today, we leverage an extensive international nuclear fuel supply chain, buying natural uranium along with conversion and enrichment services. We can sustain and grow this by reinforcing global relationships.

As of 2023, the largest natural uranium suppliers to the U.S. are Canada (27%), Kazakhstan (22%), Australia (22%), Russia (12%), and Uzbekistan (10%). The rest comes from a long tail of smaller suppliers. Russia’s share has diminished since the Ukraine conflict began.

Canada and Australia are close U.S. allies, and both could increase uranium exports. Australia holds the world’s largest uranium reserves—about one third of the global total—yet accounts for only 8% of global output. Spare capacity exists.

The story in Central Asia is different.

In Kazakhstan, the U.S. faces fierce competition with Russia and China. In June 2025, Rosatom was selected to build the country’s first nuclear power plant; China is expected to build the second. Both countries are using reactor deals and entangled mining agreements to exert influence.

Similar Russian and Chinese conversations are happening in Uzbekistan, but at an earlier stage.

The current U.S. strategy is to pull these uranium stores into the Western supply chain. But as Central Asian nuclear value chains become tied to Russian and Chinese programs, more output could become politically or contractually locked to Eastern-aligned customers, leaving less flexibility in a crisis.

Opportunity 2: Mine Uranium Domestically

In 2022, the U.S. mined 75 MT of uranium. This jumped 4x to about 300 MT in 2024, but still represents a tiny fraction of the U.S. need.

This wasn’t always the case.

From 1950 to 1980, the U.S. was the world’s largest uranium producer. Early in this period, over 750 uranium mines operated across the country. At the peak in 1980, the U.S. mined 16,800 MT. This exceeds today’s annual uranium demand, highlighting the extent of uranium overproduction during this period.

The U.S. has modest uranium stores. As of 2022, an estimated 168,200 MT sits in reasonably accessible reserves—about 8.5 years of 2035 demand.

Tapping this would require scaling domestic production by over 50x. A tall order, but possible given our heritage from the 1980s. However, since then, environmental and political opposition has mounted.

Activation costs for new mines depend heavily on local factors—exploration success, geology, and logistics. Denison’s Midwest Main project in Saskatchewan offers a reference point. It’s planned to produce 2,700 MT annually for six years, with total capital costs projected at about $500M.

Opportunity 3: Expand Domestic Enrichment Capacity

The U.S. currently has about 5 million SWU of enrichment capacity at URENCO’s New Mexico facility. Centrus Energy also has limited enrichment capability at their demonstration plant, but it’s focused on producing HALEU (high-assay low-enriched uranium) at about 20% enrichment for next-generation reactors.

Two U.S. expansion projects are already planned:

URENCO will add 1.4 million SWU by 2027

Orano’s Project Ike at Oak Ridge will add “several million” SWU

Combined, these would bring U.S. enrichment capacity to around 10 million SWU.

To meet the 2035 scenario, another 6 million SWU must be installed. Based on recent projects, enrichment facilities cost $700 to $1,200 per SWU installed—a $4.2B to $7.2B investment.

Notably, URENCO and Orano are both European companies. To achieve full coverage of 2035 enrichment needs from domestic providers would cost $11.2B to $19.2B.

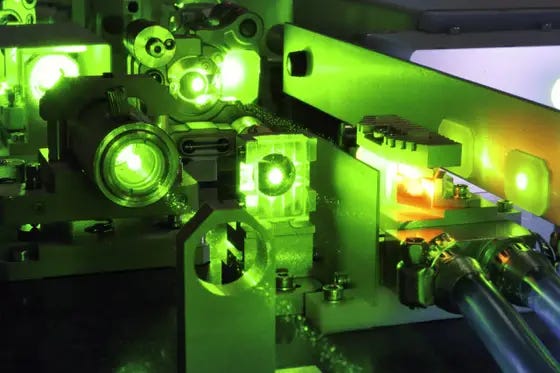

Beyond cost, centrifuge technology is a factor. Most commercial enrichment runs on gas centrifuges descended from European Zippe/URENCO designs. However, the Department of Energy is funding Centrus Energy to develop domestic centrifuges.

Opportunity 4: Reenrich Depleted Uranium

When uranium is enriched, depleted uranium is left behind. Usually, the concentration is 0.2%–0.3%. Enriching to a lower tails concentration is more expensive, and is traded against the cost of procuring more natural uranium. Yet, if we’re supply constrained, it’s possible to reenrich the depleted uranium tails, extracting additional U-235.

The Department of Energy has 750,000 MT of depleted uranium stockpiled, which we’ll assume has an average U-235 concentration of 0.3%. If we can process down to 0.1% tails, this yields about 35,000 MT of 4.4% LEU—equivalent to enriching 350,000 MT of 0.7% NatU, or about 18 years of 2035 scenario demand.

We can also do the same for newly mined uranium.

Our baseline assumes 20,000 MT of 0.7% NatU is enriched to 2,000 MT of 4.4% LEU with 0.3% tails. If we drop tails to 0.1%, we produce 2,850 MT of 4.4% LEU.

That’s 42% more product. A substantial change. We could reduce our natural uranium needs by about 30% and still achieve our current fuel production levels.

Existing gas centrifuges or laser enrichment, an emerging method, could achieve this. SILEX (Separation of Isotopes by Laser Excitation) uses lasers to excite and separate U-235 from uranium hexafluoride selectively. It claims to require substantially less energy, potentially making lower tails assays more economical.

Opportunity 5: Downblend Uranium Weapons

As we saw with Megatons to Megawatts, nuclear fuel can be made from warheads or other highly enriched uranium.

As of 2023, the U.S. had 481 tonnes of highly enriched uranium (HEU), allocated as:

361 MT for weapons

87.5 MT for naval reserve

14.3 MT for research reactors

18.4 MT for downblending

Assuming reserves are enriched to 90%, then 18.4 MT of 90% HEU could be downblended to 375 MT of 4.4% LEU, which is equivalent to 3,750 MT of 0.7% NatU, or about two months of 2035 demand.

If all HEU—including every weapon in the arsenal—were converted to reactor fuel, it would yield 9,800 MT of 4.4% LEU, or five years of 2035 demand. But the U.S. isn’t going to abandon nuclear weapons.

Therefore, while downblending weapons uranium is possible, current stores don’t move the needle much.

Opportunity 6: Use Plutonium Weapons for MOX

Mixed Oxide Fuel (MOX) is a blend of 3% to 12% plutonium and depleted uranium. The resulting mixture is approximately equivalent to LEU and can power many reactors. In France, about 10% of electricity comes from MOX.

Besides uranium weapons, the U.S. also has plutonium stores, some of which could be converted to MOX.

The last detailed reporting on the U.S. plutonium stockpile was in 2012:

99.5 MT total plutonium

66 MT considered surplus, not slated for weapons

Of the surplus, 34 MT is slated for conversion to MOX

Assuming the MOX uses 5% plutonium, we can calculate the reactor fuel produced and the natural uranium it would replace:

34 MT plutonium creates 680 MT MOX, replacing 6,800 MT of 0.7% NatU

66 MT plutonium creates 1,320 MT MOX, replacing 13,200 MT of 0.7% NatU

Utilizing plutonium for MOX isn’t a volume play. It represents less than a year of the 2035 need. Instead, it’s most useful to jumpstart fast reactor development, which requires MOX at higher concentrations. This is where DOE’s current commercial plutonium allocations are expected to go.

Opportunity 7: Reprocess Spent Reactor Fuel

In the U.S., this spent fuel is not reprocessed. Instead, it’s stored at plants in spent fuel pools or dry casks. The U.S. has accumulated about 90,000 MT of spent nuclear fuel over sixty years, adding about 2,000 MT annually.

In other countries, spent fuel is reprocessed to create additional fuel. Globally, about 400,000 MT of spent fuel have been produced, of which roughly 30% has been reprocessed.

Spent reactor fuel from light water reactors consists of roughly:

95% Uranium-238

1% (or less) Uranium-235

3% Fission products

1% Plutonium

1% Minor actinides (neptunium, americium, curium)

Reprocessing uses chemical and pyro processes to separate spent fuel constituents:

Plutonium can be used to make MOX

Uranium-235 can create traditional fuel

Uranium-238 can be used in MOX or loaded into Pressurized Heavy Water Reactors

Separation creates a proliferation challenge. If plutonium is isolated, it could be stolen or diverted to weapons programs. This is one of the main reasons the U.S. has opposed domestic reprocessing. However, strategies exist to combat this risk. Plutonium can be converted into MOX almost immediately, limiting its time in pure form. Even better, some processes never completely separate it, leaving plutonium partially mixed with uranium before conversion.

The U.S. could use reprocessing to extract useful fuel from decades of spent fuel stores. The 90,000 MT of spent fuel contains about:

900 MT plutonium, which can create 18,000 MT MOX, replacing 180,000 MT NatU (~9 years of demand)

90,000 MT of 1% recovered uranium creates 18,800 MT of 4.4% LEU, replacing 188,000 MT NatU equivalent (~10 years of demand)

Combined, reprocessing the U.S. stockpile could net 19 years of reactor fuel supply.

Additionally, every batch of reactor fuel could be reprocessed going forward. Given 2,000 MT of annual spent fuel:

20 MT plutonium creates 400 MT MOX, replacing 4,000 MT NatU equivalent

2,000 MT of 1% recovered uranium creates 420 MT of 4.4% LEU, replacing 4,200 MT NatU equivalent

Combined, this yields about 820 MT of reactor fuel, which 41% of the original 2,000 MT fuel load. Note that the uranium portion would need to be further enriched, which is reflected in these numbers.

If we did once-through reprocessing, this would reduce our overall natural uranium needs by about 29% for the equivalent fuel production.

Reprocessing is a proven approach. Orano operates La Hague, a large reprocessing complex on the Cotentin Peninsula in northern France. Built in the 1960s for about $20B in modern dollars, the plant handles about 1,700 MT of spent fuel per year.

Opportunity 8: Deploy Fast Reactors

Fast reactors offer a fundamentally different approach to nuclear fuel. Rather than finding new uranium sources, they extract more value from what we already have. In a fast-neutron spectrum, abundant U-238 can be converted into fissile plutonium-239 while generating power.

These reactors typically use MOX or metallic alloy fuels with higher fissile content than light water reactors. More importantly, their fuel can reach significantly higher burnup levels, extracting far more of the energy contained initially in natural uranium.

Conventional light water reactors consume only a small fraction before fuel is discharged. Fast reactors with closed fuel cycles can, in principle, use a much larger share, improving resource efficiency by an order of magnitude or more.

This has significant implications for spent fuel. The stockpile at U.S. reactor sites contains an enormous amount of untapped energy. Fully exploiting it would require extensive deployment of fast reactors and mature recycling infrastructure, but the theoretical resource is vast.

The obstacle isn’t physics. It’s time, infrastructure, and cost. Fast reactors require an initial inventory of plutonium or high-assay uranium, along with reprocessing facilities to close the fuel cycle. Building this out would take decades, substantial capital, and the persistence required for long-horizon hardware programs.

Russia operates the only commercial fast reactor program today, and even there, the fleet is small—just two reactors. For the U.S., fast reactors could be a long-term strategic option, more so than a near-term supply chain fix.

Putting it all together

All of these opportunities can be combined in different ways. Below is what one path for the U.S. might look like. It’s somewhat idealized, and inefficiencies may erode certain numbers. Impacts should be considered on an order-of-magnitude basis.

Backdrop

We start with our 2035 scenario and assume Central Asian geopolitics have trended unfavorably.

We need 20,000 MT of 0.7% NatU and 16 million SWU per year to create 2,000 MT of 4.4% LEU.

Russia, Kazakhstan, and Uzbekistan stop exporting uranium to the U.S.

Impact: 13,600 MT of 0.7% NatU annual supply (68% of need)

Step 1

Step 1 actions are mainly operational and can be completed without significant new technology. They could fit within a 5-year horizon.

Increase domestic uranium production 10x to 3,000 MT for $500M

Impact: Uranium supply increased to 16,600 MT (83% of need)

Increase Canadian and Australian uranium imports by 35% (+3,400 MT)

Impact: Uranium supply increased to 20,000 MT (100% of need)

Complete planned U.S. enrichment buildouts by URENCO and Orano

Impact: 10 million SWU (62% of need)

Step 2

Step 1 shores up the uranium supply but still requires significant imports of both uranium and enrichment services from abroad.

Activate reenrichment (SILEX and centrifuge) and enrich down to 0.1% tails, reducing uranium need by 30%

Impact: Uranium need drops from 20,000 MT to 14,000 MT

Activate a 2,500 MT reprocessing facility to increase fuel utilization by 29% using both recycled plutonium and uranium. Cost estimated at $20B.

Impact: Uranium need drops from 14,000 MT to 9,950 MT, 30% from the U.S.

Build an additional 10 million SWU of domestic enrichment at a cost of $7B to $12B

Impact: Support for 100% domestic new uranium enrichment, reenrichment, and reprocessing

Reserves

Once SILEX and reprocessing are online, we can also tap existing stockpiles.

Reenriching the U.S. stockpile of depleted uranium to 0.1% tails provides 18 years of reactor fuel.

Reprocessing the existing stockpile of spent reactor fuel provides 19 years of reactor fuel.

Combined, this provides 37 years of reactor fuel, which is a sizable buffer.

This two-step scenario allows the U.S. to reinforce supply through mining and allied partnerships while building out infrastructure for laser enrichment and reprocessing. While it enables complete detachment from Kazakhstan and Uzbekistan, maintaining interests in Central Asia is geopolitically beneficial.

Outlook

The opportunities in this scenario are just one way to achieve nuclear fuel security. There are many others. In this case, we maintained some allied imports to avoid exhausting domestic uranium stocks too quickly. A 100% domestic solution is also possible, but would rely on finding or accessing increased uranium stores. We could also consider creating natural uranium reserves through stockpiling.

The main takeaway: pathways exist. They’re not short—perhaps 10 to 20 years. And they’re not cheap—tens of billions of dollars. But they’re there and growing. While SILEX scaling still needs to be demonstrated, reprocessing has a 60-year heritage.

There are risks. SILEX and reprocessing both present proliferation challenges. Laser enrichment units are expected to be relatively small and consume little power. This creates a risk that they will walk away into the wrong hands. Reprocessing can isolate plutonium, which also makes it potentially mobile. Even a small amount could accelerate a weapons program.

Fast reactors represent another paradigm. The best time to ramp up these efforts would be after reprocessing comes online. To be maximally effective, the U.S. would want a tailored reactor fleet—light water reactors, fast reactors, and potentially some CANDU plants that don’t require enriched fuel. Many studies have explored such arrangements, but implementation requires a cohesive, state-led strategy.

The needs could also change. We didn’t explore HALEU, which is enriched to ~20%. Many new reactors are designed around this fuel type, and broad deployment would significantly increase enrichment demand.

Ultimately, all this must be considered as the U.S. seeks to jumpstart the nuclear sector. There’s much focus on the reactor fleet and emerging technologies—but without fuel, no electricity gets generated.

General References

Congressional Budget Office, Nuclear Power’s Role in Generating Electricity (Washington, DC: CBO, 2008), https://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/88xx/doc8808/11-14-nuclearfuel.pdf.

Reja Younis, “Pitting Nuclear Modernization Against Powering AI: Trump’s Plans for the US Plutonium Stockpile,” Center for Strategic and International Studies, 2025, accessed November 28, 2025, https://www.csis.org/analysis/pitting-nuclear-modernization-against-powering-ai-trumps-plans-us-plutonium-stockpile.

Denison Mines, “Denison Announces Results from Midwest ISR Preliminary Economic Assessment,” news release, October 2024, accessed November 28, 2025, https://denisonmines.com/news/denison-announces-results-from-midwest-isr-prelimi-122828/.

World Nuclear Association, “Australia,” accessed November 28, 2025, https://world-nuclear.org/information-library/country-profiles/countries-a-f/australia.

“Kazakhstan Selects Rosatom for First Nuclear Power Plant,” World Nuclear News, June 2025, accessed November 28, 2025, https://www.world-nuclear-news.org/articles/kazakhstan-selects-rosatom-for-first-nuclear-power-plant.

Eugene Rumer, “Back to the Future? Kazakhstan’s Nuclear Choice,” United States Institute of Peace, October 2024, accessed November 28, 2025, https://www.usip.org/publications/2024/10/back-future-kazakhstans-nuclear-choice.

World Nuclear Association, “Kazakhstan,” accessed November 28, 2025, https://world-nuclear.org/information-library/country-profiles/countries-g-n/kazakhstan.

U.S. Energy Information Administration, “U.S. Uranium Production Increased in 2023,” Today in Energy, June 2024, accessed November 28, 2025, https://www.eia.gov/todayinenergy/detail.php?id=62744.

“Kazakhstan to Begin Producing Its Own Nuclear Fuel,” Reuters, August 8, 2025, accessed November 28, 2025, https://www.reuters.com/business/energy/kazakhstan-begin-producing-its-own-nuclear-fuel-2025-08-08/.

William Blair, SWUning Over Nuclear Deregulation (Chicago: William Blair, 2025), https://www.williamblair.com/-/media/downloads/eqr/2025/williamblair-swuning-over-nuclear-deregulation.pdf.

GRS, “La Hague Reprocessing Plant: Expansion and Continued Operation Until at Least 2100,” accessed November 28, 2025, https://www.grs.de/en/news/la-hague-reprocessing-plant-expansion-and-continued-operation-until-least-2100.

Sam Meredith, “Nuclear Fuel Enrichers Race to Cut Dependence on Russia as AI Drives Power Demand,” CNBC, October 4, 2025, accessed November 28, 2025, https://www.cnbc.com/2025/10/04/urenco-centrus-orano-enriched-uranium-nuclear-russia-ai-data-center.html.

“Uranium Mining in Michigan’s Upper Peninsula,” MLive, accessed November 28, 2025, https://www.mlive.com/galleries/POB25Q6Z7BELZJ2HL7M3ZJMZTY/.

“Energy Resources Australia Pulls Plug on Ranger 3 Deeps Expansion,” ABC News (Australia), June 11, 2015, accessed November 28, 2025, https://www.abc.net.au/news/2015-06-11/energy-resources-australia-pulls-plug-on-3-deeps-expansion/6540046.